What Are Routing Numbers & Do Credit Cards Have One?

When managing your finances, understanding the various numbers and terms associated with your bank accounts and credit cards is crucial. A common question that often arises is: “Do credit cards have routing numbers?”

In this article, we will explore what routing numbers are, how they work, and clarify why credit cards do not have routing numbers.

What are Routing Numbers?

Before we dive into credit cards specifically, let’s discuss what routing numbers are. A routing number is a nine-digit code used by banks and financial institutions to identify themselves. Think of it as an address that tells other banks where to find your bank or financial institution in the vast network of money transfer routes.

Front Story / Essentially, a routing number is a nine-digit code banks and financial institutions use to identify themselves.

- Routing numbers are primarily used in the United States and serve several purposes:

Direct Deposits: They help route the money to the right bank during a direct deposit. - Bill Payments: They ensure your bills are paid out of the correct account when you set up automatic payments.

- Transfers: They are essential for sending money between banks, especially for ACH (Automated Clearing House) and wire transfers.

How do Routing Numbers Work?

Each routing number is unique to the bank and sometimes even to the branch. The first four digits represent the Federal Reserve routing symbol, the next four provide the institution identifier, and the last digit is a checksum used for error checking in processing the transfer.

Nilov / Pexels / When you set up a payment or direct deposit, this number is used to direct the funds to the right place.

Do Credit Cards Have Routing Numbers?

Now, back to our main query: Do credit cards have routing numbers? The simple answer is no. Credit cards operate differently from bank accounts, which require routing numbers for transactions. They use a distinct system managed by credit card networks like Visa, MasterCard, and American Express.

Why Credit Cards Don’t Need Routing Numbers?

Credit cards do not have routing numbers because they are not involved in the types of transactions that require them. Here is why:

- Credit Transactions: Instead of money being sent directly to or from your bank account, your credit card issuer processes the payment. When you make a purchase with your credit card, the card issuer pays the merchant, and then you pay back the issuer according to your credit card agreement.

- Processing Networks: Credit card transactions are processed through a network of card issuers and financial networks that are different from those used in bank-to-bank transfers. These networks use your credit card number, not a routing number, to process payments.

Pixabay / Pexels / Since credit cards do not use routing numbers, they rely heavily on credit card numbers.

Thus, each credit card number is unique and serves multiple security and identification purposes:

Issuer Identification: The first few digits of your credit card number identify the institution that issued the card.

Account Identification: The subsequent digits represent your specific account number.

Verification: The last digit is a check digit, which helps verify the card number’s validity during transactions.

These numbers ensure that your transactions are secure and that they are billed to the correct account without the need for a routing number.

So, to answer the question “Do credit cards have routing numbers?” They do not. Routing numbers are crucial for managing transactions within bank accounts but are not applicable to credit cards. Credit card transactions rely on a unique set of processes and security measures designed to facilitate quick, secure payments without directly involving your bank account’s routing information.

More in Business

-

`

What Is Generative AI vs AI – And How Do They Differ?

In the ever-evolving landscape of artificial intelligence (AI), the line between science fiction and reality continues to blur. Chatbots seamlessly navigate...

June 28, 2024 -

`

What Quarters Are Worth Money? Tips to Identify Valuable Coins Today

In coin collecting, certain quarters stand out not just for their face value but for their potential worth, much beyond that....

June 21, 2024 -

`

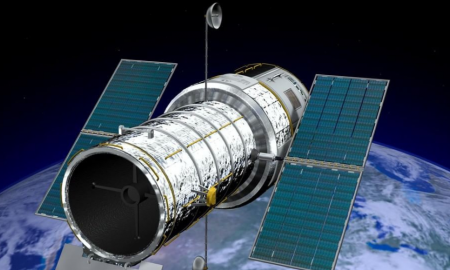

How Does the Hubble Telescope Work and Where Is It?

Have you ever gazed at the night sky and marveled at the twinkling stars and wispy clouds of gas and dust?...

June 15, 2024 -

`

5 Savings Accounts That Will Earn You the Most Money in 2024

In 2024, choosing the right savings account is more critical than ever. With the array of options available, knowing which savings...

June 5, 2024 -

`

The Complete Relationship Timeline of Taylor Swift & Travis Kelce

When you think of unlikely couples, Taylor Swift and Travis Kelce might not be the first pair that comes to mind....

May 29, 2024 -

`

What is Business Administration and What Opportunities Does it Offer?

In today’s bustling world of commerce and industry, the term “business administration” often looms large, yet its true essence remains shrouded...

May 22, 2024 -

`

What is AI? Exploring the World of Artificial Intelligence

In today’s rapidly evolving technological landscape, the term “Artificial Intelligence” (AI) has become a buzzword that sparks curiosity, speculation, and even...

May 16, 2024 -

`

How Many Jobs Are Available in Real Estate Investment Trusts? Exploring Career Opportunities

Are you seeking a career path with a blend of financial savvy and a knack for the real estate market? Look...

May 9, 2024 -

`

The Staggering Net Worth of the Richest Podcaster Joe Rogan in 2024

Joe Rogan has become a household name, largely due to his immensely popular podcast, “The Joe Rogan Experience.” With a blend...

April 29, 2024

You must be logged in to post a comment Login