Bearer Bonds: Definition, How They Work & Are They Valuable?

Bearer bonds are unique securities that have a colorful history and a distinctive way of functioning that sets them apart from more common financial instruments like stocks or standard bonds. Whether you are a seasoned investor or just dipping your toes into the world of finance, understanding bearer bonds is a fascinating journey.

Now, let’s go ahead and explore bearer bonds in detail:

What Are Bearer Bonds?

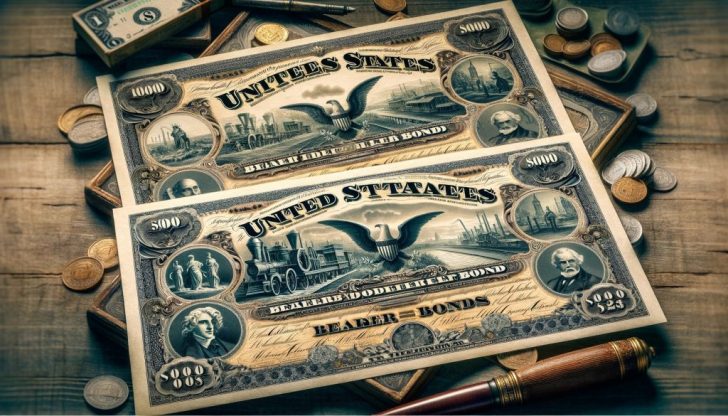

Bearer bonds are a type of fixed-income security, very much like the conventional bonds you might already be familiar with. However, there is a twist that makes these types of bonds stand out: They are owned by whoever holds the physical certificate. That is right, in the case of bearer bonds, possession truly is nine-tenths of the law.

FrontStory / Just like conventional bonds, bearer bonds are a type of fixed-income security.

Unlike registered bonds, where ownership is recorded, and interest payments are made directly to the owner, bearer bonds make no such distinctions. If you have the bond in your hands, you can claim its interest and principal payments, no questions asked.

How Do They Work?

Issued by corporations or governments, these bonds typically come with coupons attached. These coupons are essentially interest payments, and the holder can redeem them periodically until the bond matures. At maturity, the bondholder can redeem the bond for its face value.

The catch? You must physically present the bond and its coupons to claim your dues. This unique feature made bearer bonds incredibly popular for those seeking anonymity in their financial dealings.

Karolina / Pexels / Despite their security and simplicity, bearer bonds are not as common today. Why?

The answer lies in their very nature. The anonymity and physicality of bearer bonds made them ideal for less savory financial activities, including money laundering and tax evasion. Recognizing these challenges, many governments have phased out or severely restricted the issuance of new bearer bonds.

Yet, the allure of bearer bonds remains for collectors and historical investors, who value them not just for their financial worth but also for their place in financial history.

How Valuable are Bearer Bonds?

This brings us to the million-dollar question: Are bearer bonds valuable? The answer is a resounding “it depends.” For collectors and those interested in financial memorabilia, old bearer bonds can have significant historical and aesthetic value.

Financially, the value of a bearer bond would depend on its interest rate compared to current market rates, its rarity, and its condition if you are considering it as a collectible.

Grab / Pexels / While bearer bonds might seem like relics of a bygone era, they hold lessons for the modern investor.

They remind us of the importance of transparency and regulation in financial markets. For those holding old bearer bonds, it is crucial to understand their legal and financial standing. Some may still be redeemable, offering a surprising windfall. For others, the value might be more educational or aesthetic.

Quick Sum Up & Recap

Bearer bonds are a fascinating footnote in the history of finance. They offer a glimpse into past practices and underscore the evolution of financial markets toward greater transparency and regulation. Whether you are an investor, a collector, or simply curious, the world of bearer bonds is a compelling chapter in the vast narrative of global finance.

While you understand the essence of bearer bonds, it will be easy for you to navigate the complexities that come with it.

More in Finance

-

`

What Is Generative AI vs AI – And How Do They Differ?

In the ever-evolving landscape of artificial intelligence (AI), the line between science fiction and reality continues to blur. Chatbots seamlessly navigate...

June 28, 2024 -

`

What Quarters Are Worth Money? Tips to Identify Valuable Coins Today

In coin collecting, certain quarters stand out not just for their face value but for their potential worth, much beyond that....

June 21, 2024 -

`

How Does the Hubble Telescope Work and Where Is It?

Have you ever gazed at the night sky and marveled at the twinkling stars and wispy clouds of gas and dust?...

June 15, 2024 -

`

5 Savings Accounts That Will Earn You the Most Money in 2024

In 2024, choosing the right savings account is more critical than ever. With the array of options available, knowing which savings...

June 5, 2024 -

`

The Complete Relationship Timeline of Taylor Swift & Travis Kelce

When you think of unlikely couples, Taylor Swift and Travis Kelce might not be the first pair that comes to mind....

May 29, 2024 -

`

What is Business Administration and What Opportunities Does it Offer?

In today’s bustling world of commerce and industry, the term “business administration” often looms large, yet its true essence remains shrouded...

May 22, 2024 -

`

What is AI? Exploring the World of Artificial Intelligence

In today’s rapidly evolving technological landscape, the term “Artificial Intelligence” (AI) has become a buzzword that sparks curiosity, speculation, and even...

May 16, 2024 -

`

How Many Jobs Are Available in Real Estate Investment Trusts? Exploring Career Opportunities

Are you seeking a career path with a blend of financial savvy and a knack for the real estate market? Look...

May 9, 2024 -

`

The Staggering Net Worth of the Richest Podcaster Joe Rogan in 2024

Joe Rogan has become a household name, largely due to his immensely popular podcast, “The Joe Rogan Experience.” With a blend...

April 29, 2024

You must be logged in to post a comment Login