What Happened to Meta Stock After Q2 Gains?

What happened to Meta stock after its impressive Q2 performance might surprise investors anticipating a straightforward trajectory. The stock’s journey has been a mix of highs and lows, revealing the unpredictable nature of the market, especially for a tech giant like Meta. Despite a strong start following the earnings report, external factors and internal decisions have influenced its path.

Meta’s Rollercoaster Ride Post-Q2

After Meta Platforms reported stronger-than-expected second-quarter earnings, the market responded with enthusiasm. The company’s revenue surged by 22% year-over-year, reaching $39.07 billion, and earnings per share soared by 73%. These impressive figures propelled Meta stock to a 4.8% jump on August 1, signaling strong investor confidence. However, this optimism was soon tempered by broader market forces.

Investing.com | MSN | Meta’s revenue surged by 22% year-over-year, reaching $39.07 billion, and earnings per share soared by 73%.

On August 2, a weaker-than-expected U.S. jobs report sent ripples through the market, dragging Meta stock down. This was a stark reminder that even the most robust earnings can be overshadowed by macroeconomic concerns. As a result, Meta’s stock price wavered, highlighting the volatility that can accompany even the most promising financial results.

The Impact of AI Investments on Meta’s Stock

Meta’s ambitious plans to invest tens of billions of dollars into AI infrastructure have been a double-edged sword. On one hand, these investments are seen as crucial for the company’s long-term growth, especially as it aims to lead in AI-driven innovations. On the other hand, the significant capital expenditure has sparked concerns among investors wary of the immediate impact on profitability.

CEO Mark Zuckerberg’s commitment to advancing Meta’s AI capabilities was emphasized during a conference call discussing Q2 results. The company’s increased spending forecast, ranging from $37 billion to $40 billion for the year, underscores the magnitude of these ambitions. However, this aggressive investment strategy has made some investors cautious, particularly as the tech sector faces increasing scrutiny and regulatory challenges.

Regulatory Challenges Weighing on Meta

Regulatory pressures have also significantly shaped Meta’s stock performance post-Q2. The European Union’s Digital Markets Act, which places stringent restrictions on data usage by big tech companies, has already led to challenges for Meta. The company’s decision to offer paid, ad-free versions of Facebook and Instagram was an attempt to comply with these new rules. Still, it has faced criticism for not fully adhering to the legislation.

Forbes | MSN | CEO Mark Zuckerberg emphasized Meta’s commitment to advancing its AI capabilities during a conference call to discuss Q2 results.

Additionally, ongoing antitrust challenges in the U.S. complicate Meta’s future. The Federal Trade Commission’s lawsuit, which accuses Meta of abusing monopoly power, remains unresolved. While Meta continues to defend its position, the potential outcomes of these legal battles loom large for investors.

Meta Stock’s Position Among the Magnificent Seven

Meta’s stock is part of the elite group of tech giants known as the Magnificent Seven, which includes heavyweights like Apple, Microsoft, and Alphabet. Despite the strong Q2 results, Meta’s stock has experienced fluctuations alongside its peers. A notable drop occurred in late July when the collective market cap of the Magnificent Seven shed over $1 trillion, reflecting a broader investor rotation away from extensive tech stocks.

The shift in investor sentiment was driven by growing confidence in an interest rate cut, prompting some to diversify away from tech stocks and into other sectors. This rotation affected Meta’s stock, causing it to drop to a three-month low of $442.65 on July 25. However, the stock has since recovered, working its way back toward a record high, demonstrating its resilience in a turbulent market.

More in Finance

-

`

What Quarters Are Worth Money? Tips to Identify Valuable Coins Today

In coin collecting, certain quarters stand out not just for their face value but for their potential worth, much beyond that....

June 21, 2024 -

`

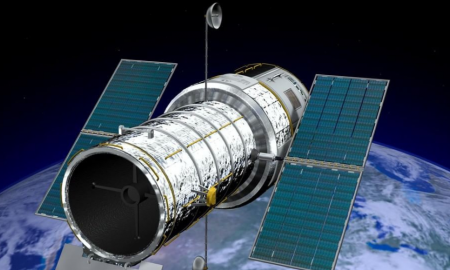

How Does the Hubble Telescope Work and Where Is It?

Have you ever gazed at the night sky and marveled at the twinkling stars and wispy clouds of gas and dust?...

June 15, 2024 -

`

5 Savings Accounts That Will Earn You the Most Money in 2024

In 2024, choosing the right savings account is more critical than ever. With the array of options available, knowing which savings...

June 5, 2024 -

`

The Complete Relationship Timeline of Taylor Swift & Travis Kelce

When you think of unlikely couples, Taylor Swift and Travis Kelce might not be the first pair that comes to mind....

May 29, 2024 -

`

What is Business Administration and What Opportunities Does it Offer?

In today’s bustling world of commerce and industry, the term “business administration” often looms large, yet its true essence remains shrouded...

May 22, 2024 -

`

What is AI? Exploring the World of Artificial Intelligence

In today’s rapidly evolving technological landscape, the term “Artificial Intelligence” (AI) has become a buzzword that sparks curiosity, speculation, and even...

May 16, 2024 -

`

How Many Jobs Are Available in Real Estate Investment Trusts? Exploring Career Opportunities

Are you seeking a career path with a blend of financial savvy and a knack for the real estate market? Look...

May 9, 2024 -

`

The Staggering Net Worth of the Richest Podcaster Joe Rogan in 2024

Joe Rogan has become a household name, largely due to his immensely popular podcast, “The Joe Rogan Experience.” With a blend...

April 29, 2024 -

`

What Are Routing Numbers & Do Credit Cards Have One?

When managing your finances, understanding the various numbers and terms associated with your bank accounts and credit cards is crucial. A...

April 24, 2024

You must be logged in to post a comment Login