Here’s Your Ultimate Small Business Tax Prep Checklist For 2024

When it is time to meet with your tax professional, having a solid small business tax prep checklist is essential. This checklist helps you gather everything you need for your appointment and ensures that you don’t miss out on deductions or credits. Being prepared not only makes the process faster but can also help reduce stress.

Financial Statements Tops Your Small Business Tax Prep Checklist!

At the top of your small business tax prep checklist, you will need your financial statements. This includes your profit and loss (P&L) statement and your balance sheet. Your P&L shows your total revenue, costs, and expenses over a given period, typically the tax year. It helps you – and your tax professional – understand how well your business performed and how much tax is owed. The balance sheet, on the other hand, provides a snapshot of your business’s financial position at a specific point in time.

So, be sure to keep them updated throughout the year to avoid scrambling at tax time. Your tax preparer will use these documents to ensure your numbers add up and to catch any discrepancies that could lead to issues down the line.

Receipts and Invoices for Business Expenses

Tax deductions play a significant role in lowering your tax bill. But they are only valid if you have proper documentation. Business expenses such as office supplies, equipment, travel, and marketing are all tax-deductible. However, you need receipts to prove the expenditures were legitimate business costs.

Alpha / Pexels / Having all your receipts and invoices handy is a crucial part of any small business tax prep checklist.

It is a good idea to organize receipts by category, such as office expenses, travel, and meals, to make things easier for your tax professional. Make sure that you keep both physical copies and digital records of your receipts in case you need to refer to them later.

Mileage Log for Business Travel

If you use a vehicle for business purposes, you’ll need to include your mileage log in your small business tax prep checklist. The IRS allows you to deduct either the actual costs of operating the vehicle or use the standard mileage rate, which changes annually. A well-maintained mileage log should include the date of travel, the purpose of the trip, starting and ending mileage, and total miles driven.

Using an app or a spreadsheet can help you track mileage accurately. This is one area that is often overlooked but can lead to significant deductions when done correctly. Just remember, personal trips don’t count. So, be sure to clearly separate business and personal travel.

Payroll Records and Employee Information

You will need to provide your tax preparer with employee W-2 forms, which detail how much you’ve paid in wages and how much tax has been withheld. Additionally, you’ll need to account for any bonuses, benefits, or other compensation that may affect your tax filing.

FrontStory FrontStory / If your small business has employees, payroll records are essential items on your tax preparation checklist.

However, independent contractors, freelancers, or gig workers that you’ve hired should receive a 1099-NEC form. Keep all records of payments made to these workers handy, as your tax preparer will need this information to correctly report wages. Clear and organized payroll records prevent issues with the IRS and ensure your filings are accurate.

Last Year’s Tax Return

Another crucial element of your small business tax prep checklist is last year’s tax return. Providing your tax preparer with your previous return can help them identify any carryover deductions, such as depreciation or net operating losses. It also serves as a reference point for ensuring consistency and flagging any changes that may need further explanation.

However, if your business has changed structure or your financial situation has shifted, your tax preparer will need to address these differences properly.

More in Business

-

`

What Quarters Are Worth Money? Tips to Identify Valuable Coins Today

In coin collecting, certain quarters stand out not just for their face value but for their potential worth, much beyond that....

June 21, 2024 -

`

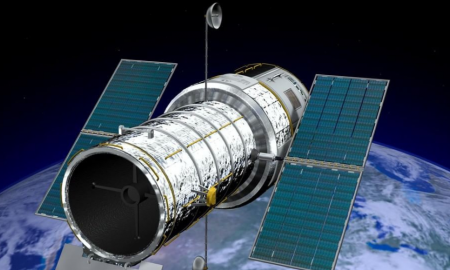

How Does the Hubble Telescope Work and Where Is It?

Have you ever gazed at the night sky and marveled at the twinkling stars and wispy clouds of gas and dust?...

June 15, 2024 -

`

5 Savings Accounts That Will Earn You the Most Money in 2024

In 2024, choosing the right savings account is more critical than ever. With the array of options available, knowing which savings...

June 5, 2024 -

`

The Complete Relationship Timeline of Taylor Swift & Travis Kelce

When you think of unlikely couples, Taylor Swift and Travis Kelce might not be the first pair that comes to mind....

May 29, 2024 -

`

What is Business Administration and What Opportunities Does it Offer?

In today’s bustling world of commerce and industry, the term “business administration” often looms large, yet its true essence remains shrouded...

May 22, 2024 -

`

What is AI? Exploring the World of Artificial Intelligence

In today’s rapidly evolving technological landscape, the term “Artificial Intelligence” (AI) has become a buzzword that sparks curiosity, speculation, and even...

May 16, 2024 -

`

How Many Jobs Are Available in Real Estate Investment Trusts? Exploring Career Opportunities

Are you seeking a career path with a blend of financial savvy and a knack for the real estate market? Look...

May 9, 2024 -

`

The Staggering Net Worth of the Richest Podcaster Joe Rogan in 2024

Joe Rogan has become a household name, largely due to his immensely popular podcast, “The Joe Rogan Experience.” With a blend...

April 29, 2024 -

`

What Are Routing Numbers & Do Credit Cards Have One?

When managing your finances, understanding the various numbers and terms associated with your bank accounts and credit cards is crucial. A...

April 24, 2024

You must be logged in to post a comment Login