The Petrodollar & Saudi Arabia: Surprising Facts You Need to Know

Petrodollar Saudi Arabia is a term that has long been associated with the unique financial arrangement between Saudi Arabia and the United States. This system, although unofficial, has significantly influenced global economics and the positioning of the US dollar. Understanding the petrodollar system’s origins, evolution, and current state is crucial for comprehending its impact on the world economy.

Origins of the Petrodollar System

Petrodollar emerged after the US abandoned the gold standard in 1971, which ended the Bretton Woods system. This transition threw the international financial system into turmoil, characterized by high inflation and a devalued dollar.

The US negotiated with Saudi Arabia in 1974 to stabilise the situation. This agreement stipulated that Saudi Arabia would sell its oil exclusively in US dollars. In return, the US promised military protection and economic cooperation.

Joseph Adinolfi | MSN | Petrodollar emerged after the US abandoned the gold standard in 1971, which ended the Bretton Woods system.

This arrangement ensured the global oil trade would be conducted in dollars, creating a new form of implicit backing for the US currency. This move significantly bolstered the dollar’s stability and demand, ensuring its dominance as the world’s primary reserve currency.

The Economic Impact of the Petrodollar

The petrodollar system facilitated an enormous influx of dollars into global markets. Oil-exporting countries, flush with US dollars from oil sales, often recycled these dollars back into the US economy through investments in US Treasury securities and other assets. This cycle reinforced the dollar’s value and gave the US a unique economic advantage: the ability to run large trade deficits without devaluing its currency.

However, this arrangement was about more than just economic benefits. The petrodollar system also cemented a strategic alliance between the US and Saudi Arabia. The military and economic cooperation between the two countries ensured a steady flow of oil and maintained stability in the global energy market.

Challenges and Changes in the Petrodollar System

Despite its initial success, the petrodollar system has faced significant challenges. The oil shock of 1978-79, driven by the Iranian Revolution, tested the system’s resilience. The subsequent actions by the US Federal Reserve, under Chairman Paul Volcker, to control inflation through aggressive interest rate hikes reinforced the dollar’s credibility. This period highlighted the US’s willingness to endure economic pain to maintain the dollar’s stability, thus preserving the petrodollar system’s integrity.

However, the early 2000s marked the beginning of a long-term shift. Rising oil prices, driven by increased demand from countries like China and the depletion of easily accessible oil reserves, put pressure on the petrodollar system. The dollar’s weakening against other significant currencies further strained the system. The financial crisis of 2008 exacerbated these issues, as the US engaged in extensive quantitative easing, undermining the dollar’s value and raising doubts about the sustainability of the petrodollar arrangement.

The Emerging Petroyuan

One of the most significant challenges to the petrodollar system has been the rise of China as a global economic power. As the world’s largest oil importer, China has sought to diminish its reliance on the US dollar. In 2018, China introduced yuan-priced oil contracts, a move aimed at internationalizing its currency and reducing the dominance of the petrodollar.

The geopolitical landscape further shifted with the conflict in Ukraine and the subsequent sanctions on Russia. These developments led to increased oil trade between China and Russia, conducted in yuan, signalling a move towards what some analysts have termed the petroyuan. This shift indicates a broader trend of countries seeking to diversify away from the dollar in their energy transactions, challenging the long-standing petrodollar system.

Future Outlook for the Petrodollar System

While the petrodollar system has been remarkably resilient, its future is increasingly uncertain. Saudi Arabia has shown signs of openness to conducting oil transactions in currencies other than the dollar, reflecting a broader trend among oil-exporting countries to diversify their currency reserves. The BRICS nations, including China and India, have expressed a desire to increase trade in local currencies, further eroding the dominance of the petrodollar.

In January 2023, Saudi Arabia publicly stated its willingness to accept other currencies for oil sales, marking a significant shift in its economic policy. This move aligns with Saudi Arabia’s broader economic diversification goals and reflects its strategic pivot towards strengthening ties with other major economies, particularly China.

More in Business

-

`

What Quarters Are Worth Money? Tips to Identify Valuable Coins Today

In coin collecting, certain quarters stand out not just for their face value but for their potential worth, much beyond that....

June 21, 2024 -

`

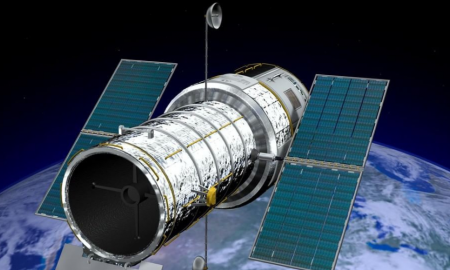

How Does the Hubble Telescope Work and Where Is It?

Have you ever gazed at the night sky and marveled at the twinkling stars and wispy clouds of gas and dust?...

June 15, 2024 -

`

5 Savings Accounts That Will Earn You the Most Money in 2024

In 2024, choosing the right savings account is more critical than ever. With the array of options available, knowing which savings...

June 5, 2024 -

`

The Complete Relationship Timeline of Taylor Swift & Travis Kelce

When you think of unlikely couples, Taylor Swift and Travis Kelce might not be the first pair that comes to mind....

May 29, 2024 -

`

What is Business Administration and What Opportunities Does it Offer?

In today’s bustling world of commerce and industry, the term “business administration” often looms large, yet its true essence remains shrouded...

May 22, 2024 -

`

What is AI? Exploring the World of Artificial Intelligence

In today’s rapidly evolving technological landscape, the term “Artificial Intelligence” (AI) has become a buzzword that sparks curiosity, speculation, and even...

May 16, 2024 -

`

How Many Jobs Are Available in Real Estate Investment Trusts? Exploring Career Opportunities

Are you seeking a career path with a blend of financial savvy and a knack for the real estate market? Look...

May 9, 2024 -

`

The Staggering Net Worth of the Richest Podcaster Joe Rogan in 2024

Joe Rogan has become a household name, largely due to his immensely popular podcast, “The Joe Rogan Experience.” With a blend...

April 29, 2024 -

`

What Are Routing Numbers & Do Credit Cards Have One?

When managing your finances, understanding the various numbers and terms associated with your bank accounts and credit cards is crucial. A...

April 24, 2024

You must be logged in to post a comment Login