5 Smart Tips for Money Management in Your 20s

Your 20s are an exciting time, full of new experiences and opportunities, but they’re also the best time to lay the groundwork for financial success. When it comes to money management in your 20s, the earlier you start, the better off you’ll be in the future.

Many people in this phase may not yet have hit their career peak, but that doesn’t mean they can’t begin securing their financial well-being. With a few well-thought-out strategies, you can build a solid foundation that will serve you throughout life.

Master Money Management in Your 20s with These Tips

1. Spend Less Than You Earn

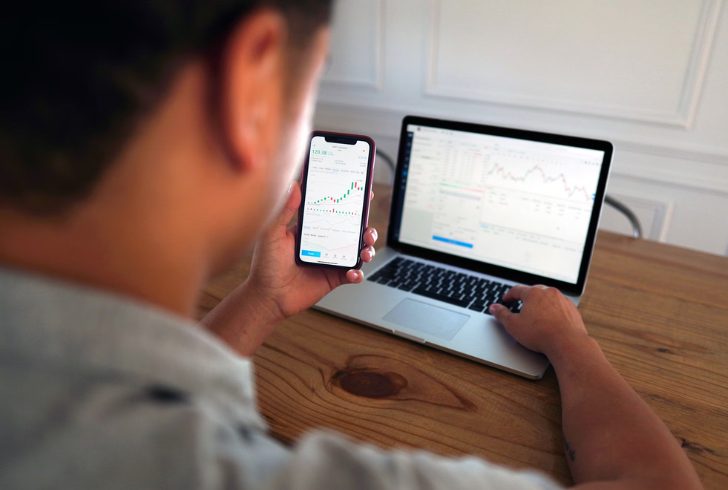

Pexels | Karolina Kaboompics | Create a budget to prioritize savings and build a strong financial foundation.

The cornerstone of good financial health is consistently spending less than you earn. It might sound basic, but this fundamental rule is one of the most effective ways to stay financially secure, especially with the rising cost of living. It’s easy to let expenses creep up, but sticking to a budget can help prevent this. Creating a budget allows you to track where your money goes each month, making it easier to spot areas where you can cut back.

A useful tip is to automate your savings. By setting up an automatic transfer from your checking account to a high-yield savings account, you can save a portion of your income without even thinking about it. Over time, you won’t even notice the difference, but you’ll see your savings grow.

2. Building an Emergency Fund

Unexpected expenses are a fact of life, and without proper planning, they can put a serious dent in your finances. This is where having an emergency fund becomes crucial. Ideally, you should aim to save enough to cover three to six months of living expenses. However, in today’s uncertain world, some experts suggest building a cushion that could cover up to 12 months of costs.

To make this easier, set aside small, consistent amounts each paycheck and deposit them into a separate account. High-yield savings accounts are a good option because they offer a better interest rate than traditional accounts, allowing your emergency fund to grow while staying accessible.

3. Make the Most of High-Yield Savings Accounts

Many people miss out on extra earnings by keeping their money in a regular checking or savings account with low interest. Moving your funds to a high-yield savings account can make a noticeable difference in how much interest you earn.

While traditional banks offer minimal interest—sometimes as low as 0.01%—high-yield savings accounts from online banks can offer upwards of 4% or more. Over time, this difference in interest rates can result in thousands of dollars earned. Just make sure the online bank you choose is FDIC-insured for protection.

4. Learn How to Invest Early

Saving money is essential, but saving alone won’t help you grow wealth in the long term. That’s where investing comes into play. Money management in your 20s is incomplete without learning to invest. With inflation eating away at your savings, investing helps your money grow faster and beat inflation over time.

Unsplash | Joshua Mayo | Explore investment options, stock market fundamentals, and key terms. Books, podcasts, and online courses can help you get started.

Begin by educating yourself on investment options, stock market basics, and terminology. Resources like beginner-friendly books, podcasts, and online courses can be invaluable. You can also explore investment platforms or brokerages that offer educational materials for novice investors. By starting in your 20s, you allow your money to compound over time, meaning it will grow exponentially in the future.

5. Create a Savings Bucket System

Setting up separate savings accounts, or “buckets,” for different goals is another excellent strategy for managing your money. These buckets allow you to allocate specific funds for things like vacations, medical expenses, or future purchases, so you’re always prepared when the time comes.

Using a high-yield savings account for each bucket means you’re not only setting aside money for future expenses but also earning interest on those funds in the meantime. For maximum efficiency, automate transfers into each savings bucket every payday. This strategy ensures you’re steadily working toward your goals without the temptation to overspend in other areas.

Take Control of Your Financial Future in Your 20s

Building solid financial habits in your 20s is one of the most important steps you can take toward securing your future. By following these smart money management strategies—spending less than you earn, creating an emergency fund, investing early, using high-yield savings accounts, and creating savings buckets—you’ll be on your way to a financially secure and prosperous future.

Mastering money management in your 20s doesn’t have to be difficult, but it does require discipline and planning. Implement these strategies, and you’ll be setting the stage for long-term success.

More in Finance

-

`

What Quarters Are Worth Money? Tips to Identify Valuable Coins Today

In coin collecting, certain quarters stand out not just for their face value but for their potential worth, much beyond that....

June 21, 2024 -

`

How Does the Hubble Telescope Work and Where Is It?

Have you ever gazed at the night sky and marveled at the twinkling stars and wispy clouds of gas and dust?...

June 15, 2024 -

`

5 Savings Accounts That Will Earn You the Most Money in 2024

In 2024, choosing the right savings account is more critical than ever. With the array of options available, knowing which savings...

June 5, 2024 -

`

The Complete Relationship Timeline of Taylor Swift & Travis Kelce

When you think of unlikely couples, Taylor Swift and Travis Kelce might not be the first pair that comes to mind....

May 29, 2024 -

`

What is Business Administration and What Opportunities Does it Offer?

In today’s bustling world of commerce and industry, the term “business administration” often looms large, yet its true essence remains shrouded...

May 22, 2024 -

`

What is AI? Exploring the World of Artificial Intelligence

In today’s rapidly evolving technological landscape, the term “Artificial Intelligence” (AI) has become a buzzword that sparks curiosity, speculation, and even...

May 16, 2024 -

`

How Many Jobs Are Available in Real Estate Investment Trusts? Exploring Career Opportunities

Are you seeking a career path with a blend of financial savvy and a knack for the real estate market? Look...

May 9, 2024 -

`

The Staggering Net Worth of the Richest Podcaster Joe Rogan in 2024

Joe Rogan has become a household name, largely due to his immensely popular podcast, “The Joe Rogan Experience.” With a blend...

April 29, 2024 -

`

What Are Routing Numbers & Do Credit Cards Have One?

When managing your finances, understanding the various numbers and terms associated with your bank accounts and credit cards is crucial. A...

April 24, 2024

You must be logged in to post a comment Login