Will the History of Inflation Surge Repeat Itself?

After a tumultuous few years amid the pandemic, many people are beginning to wonder about inflation. With prices on the rise and interest rates low, some are afraid that we might be facing a repetitious surge in inflation similar to that of the 1970s. While there are some similarities between the two eras, the reality is that many things have changed in the last 50 years.

Today, we will explore the potential for an inflation surge, examine the differences between now and then, and look at what we can do to prepare for any inflation that may come our way.

Karolina / Pexels | Back in the 1970s, the world saw one of the worst inflation surges in history.

Starting From the Basics: What Is Inflation?

Let’s start with the basics. Inflation is the rate at which prices for goods and services increase over time. It is usually measured using the Consumer Price Index (CPI), which tracks the cost of a basket of goods and services. Inflation can happen for many reasons. These include an increase in the money supply, higher demand for goods and services, or a decrease in supply.

The U.S. Federal Reserve targets an inflation rate of 2% each year, which is considered healthy for the economy. Anything above that could cause problems.

The Similarities Between Now and Then (The 1970s)

So, what makes some people think we are in for a repeat of the 1970s? One thing is the increase in government spending. After all, during the 1970s, the Vietnam War and other domestic programs caused a large increase in the federal budget.

Anna / Pexels | Essentially, inflation refers to the rate at which prices for goods and services increase over time.

Similarly, during the pandemic, the government spent trillions of dollars on stimulus packages, which could affect inflation down the road. Another possible similarity is the increase in wage pressures.

Back then, the labor force was growing, and wages were on the rise – something that put more money into circulation. Today, wages are also increasing, although this is partially due to the worker shortage brought on by the pandemic.

The Differences Between Now and Then

While there are some similarities, there are also stark differences between the two eras. For one, the structure of the economy has changed dramatically. During the 1970s, the United States was a manufacturing-based economy, and most consumer goods were made domestically.

Today, the economy is more service-based and globalized. This means that price pressures may come from different sources. And it may be easier to import goods from other countries to meet demand. Another significant difference is the role of technology.

Ed / Pexels | Unlike in the 1970s, today’s economy has become more globalized.

During the 1970s, there was no such thing as the Internet or eCommerce. Today, these innovations allow for greater price transparency and competition, which could keep inflation in check.

How American Consumers Can Prepare for the Worst

No one can predict with certainty whether we will see a 1970s-style surge in inflation. However, there are some steps we can take to prepare ourselves financially. One is to diversify our investments. This means spreading our money across different assets. These include such as stocks, bonds, and real estate. Another is to pay down any high-interest debt.

If inflation rates go up, so too will interest rates, which could make it harder to pay off loans. Finally, we can also make sure we have a healthy emergency fund. This will help us weather any financial storms that come our way.

More in Finance

-

`

“Say Anything” Star John Cusack’s Complete Dating History

Hollywood icon John Cusack has played numerous charming roles on the big screen, making it easy for fans to fall in...

July 9, 2024 -

`

The Petrodollar & Saudi Arabia: Surprising Facts You Need to Know

Petrodollar Saudi Arabia is a term that has long been associated with the unique financial arrangement between Saudi Arabia and the...

July 4, 2024 -

`

What Is Generative AI vs AI – And How Do They Differ?

In the ever-evolving landscape of artificial intelligence (AI), the line between science fiction and reality continues to blur. Chatbots seamlessly navigate...

June 28, 2024 -

`

What Quarters Are Worth Money? Tips to Identify Valuable Coins Today

In coin collecting, certain quarters stand out not just for their face value but for their potential worth, much beyond that....

June 21, 2024 -

`

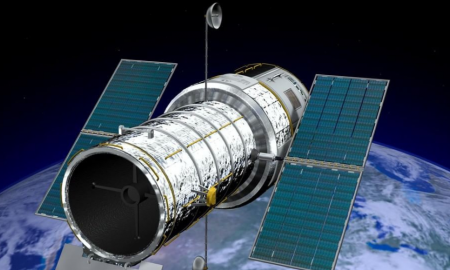

How Does the Hubble Telescope Work and Where Is It?

Have you ever gazed at the night sky and marveled at the twinkling stars and wispy clouds of gas and dust?...

June 15, 2024 -

`

5 Savings Accounts That Will Earn You the Most Money in 2024

In 2024, choosing the right savings account is more critical than ever. With the array of options available, knowing which savings...

June 5, 2024 -

`

The Complete Relationship Timeline of Taylor Swift & Travis Kelce

When you think of unlikely couples, Taylor Swift and Travis Kelce might not be the first pair that comes to mind....

May 29, 2024 -

`

What is Business Administration and What Opportunities Does it Offer?

In today’s bustling world of commerce and industry, the term “business administration” often looms large, yet its true essence remains shrouded...

May 22, 2024 -

`

What is AI? Exploring the World of Artificial Intelligence

In today’s rapidly evolving technological landscape, the term “Artificial Intelligence” (AI) has become a buzzword that sparks curiosity, speculation, and even...

May 16, 2024

You must be logged in to post a comment Login