Can investing in Nvidia Still Offer Value After Its Explosive Growth?

This year, Nvidia has been one of the stock market’s most impressive performers. Starting at $50 per share (split-adjusted) in January, the stock skyrocketed to over $145 by November. This nearly 195% year-to-date growth has captivated investors and raised critical questions about its future. With its dominance in AI and data center technologies, Nvidia remains a key tech sector player. But does investing in Nvidia now still offer value? Let’s explore the details.

Nvidia’s Third-Quarter Highlights

In its third quarter, Nvidia reported revenue of $35.1 billion, reflecting a remarkable 94% increase year over year. Non-GAAP diluted earnings per share (EPS) surged 103% during the same period. The company’s data center segment, driven by AI computing solutions, accounted for 88% of total revenue, with a stunning 112% annual growth. Other segments, including gaming and professional visualization, also posted gains, though at a slower pace.

This exceptional growth underscores Nvidia’s leadership in AI hardware. However, maintaining such momentum becomes increasingly challenging, particularly as comparisons to earlier triple-digit growth periods become relevant.

Upcoming Launch: Blackwell GPUs

Nvidia’s forthcoming Blackwell GPUs represent a critical milestone. These chips promise improved performance and energy efficiency, building on the success of the current H100 model. Early tests against industry benchmarks suggest that Blackwell could deliver up to 2.2 times more performance per GPU.

The potential for these chips to drive another wave of demand is substantial. However, competition from rivals like AMD and evolving customer preferences could impact Nvidia’s ability to dominate the market in the long term.

Factors Influencing Nvidia’s Valuation

Investors must consider whether Nvidia’s current stock price aligns with its future earnings potential. The stock trades at a high price-to-earnings ratio, reflecting strong market optimism about its prospects. While this optimism has been validated by recent performance, any failure to meet lofty expectations could lead to sharp price corrections.

Nvidia’s high valuation also suggests that investors are betting heavily on continued AI infrastructure growth. With AI adoption still in its early stages, the company’s reliance on this sector leaves it vulnerable to shifts in demand or slower-than-expected adoption rates.

Challenges in the AI and Semiconductor Markets

Nvidia’s growth largely depends on the sustained expansion of AI technologies. According to industry research, while many businesses continue to invest in AI, only 20% report tangible earnings benefits. If the return on AI investments doesn’t improve, spending on related infrastructure could slow, directly impacting Nvidia’s revenue streams.

Additionally, regulatory constraints could limit Nvidia’s opportunities in key markets like China. The U.S. Department of Commerce’s restrictions on exporting high-powered chips to certain regions may reduce Nvidia’s addressable market. With China representing a significant share of global semiconductor demand, this is a factor investors cannot ignore.

Competitive Pressures in AI Chips

Nvidia faces growing competition, not just from traditional rivals like AMD but also from major cloud providers such as Amazon, Microsoft, and Google. These companies are increasingly developing their own AI chips to reduce dependency on Nvidia. AMD’s recent advancements, including its MI325X chip, highlight the competitive threat.

The rise of in-house solutions by Nvidia’s largest customers adds another layer of complexity. While these tech giants currently rely on Nvidia for AI hardware, their internal developments could reduce future demand for Nvidia’s products.

Nvidia’s Risk Profile and Volatility

Nvidia’s stock has a history of significant volatility. While its long-term performance has been strong, the company has experienced sharp declines, such as its 50% drop in 2022. These fluctuations make it imperative for investors to assess their risk tolerance before committing to a position.

Diversification is key to managing exposure to Nvidia’s inherent risks. A balanced portfolio ensures that any sudden drops in Nvidia’s stock price won’t significantly impact overall net worth. This approach is particularly important for a high-growth stock with a history of dramatic value changes.

More in Business

-

`

Ben Affleck, Gillian Anderson to Lead Netflix Movie ‘Animals’

Netflix has officially announced “Animals,” an upcoming crime thriller featuring Oscar-winner Ben Affleck in both a lead role and as the...

February 19, 2025 -

`

US Opposes Hezbollah Ally’s Appointment to Lebanon’s Finance Ministry

The United States is actively pressuring Lebanese officials to block Hezbollah and its allies from selecting the country’s next finance minister....

February 12, 2025 -

`

Ed Sheeran Becomes the First International Artist to Perform in Bhutan

Ed Sheeran has achieved a groundbreaking milestone in his music career. The “Bad Habits” singer, 33, became the first international artist...

February 5, 2025 -

`

New Jersey Issues Warning to 11,000 Businesses for Selling Flavored Vapes

In New Jersey, flavored vape products are illegal, but thousands of businesses continue to violate the law. According to Attorney General...

January 29, 2025 -

`

Why Prince Harry and Meghan Markle Hide Their Children’s Faces Online

Prince Harry and Meghan Markle remain two of the most talked-about public figures, yet their approach to sharing details about their...

January 22, 2025 -

`

Why Are Innovation Hubs Crucial for Entrepreneurial Success?

Innovation hubs are transformative spaces that empower entrepreneurs by providing the resources, mentorship, and collaborative environments needed to turn their ideas...

January 14, 2025 -

`

How to Finance an ATM Business in 3 Easy-to-Follow Steps

Starting an ATM business can be a fantastic way to earn passive income, but the first hurdle is figuring out how...

December 19, 2024 -

`

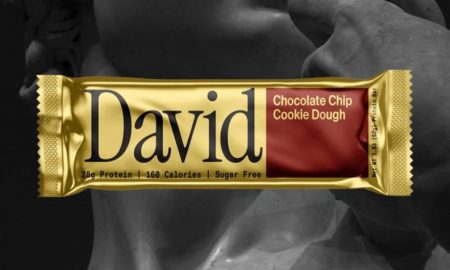

Former RXBar CEO Peter Rahal is Betting Everything on New Protein Bar Startup, David

Peter Rahal, the visionary entrepreneur behind RXBar, is back with a bold new venture. After selling RXBar to Kellogg’s for a...

December 15, 2024

You must be logged in to post a comment Login