7 Hidden Traps That Are Quietly Draining Your Wealth

Financial pressure is weighing heavily on Americans but what’s hurting wallets isn’t always what makes headlines. While inflation and housing costs dominate conversations, less obvious money traps are quietly chipping away at people’s ability to build lasting wealth.

These everyday habits and financial decisions may appear harmless at first, but they have the potential to create long-term setbacks that are hard to recover from if left unchecked.

1. Soaring Car Insurance Rates

Car insurance premiums have seen a steep climb, with a 7% jump year-over-year, almost triple the overall inflation rate. That’s not just a minor annoyance; it’s a silent monthly cost increase that many overlook.

Shopping around for new providers can lead to notable savings, sometimes trimming off 15% or more. Yet, many stick with the same insurer out of habit, draining potential wealth that could be rerouted into smarter financial channels.

2. Emotional Investing

Freepik | TriangleProd | Stay calm during market drops to avoid emotional mistakes and protect your investments.

Stock market turbulence in 2025 has been frequent and intense, driven by shifting tariffs and global uncertainty. When investors react emotionally—especially during dips—they tend to make costly mistakes like selling low and missing out on the rebound.

Long-term investing strategies are far more effective for growing wealth. Learning to stomach short-term volatility and staying consistent helps avoid the emotional rollercoaster that often results in financial losses.

3. Low-Interest Savings Accounts

Nationally, savings accounts are averaging a dismal 0.42% return, which barely registers compared to the current inflation rate. Parking cash in these accounts is like leaving it to slowly lose value.

Instead, high-yield savings accounts from insured banks are offering between 4% to 4.5%, which not only matches but can outpace inflation. These accounts are a safer and more productive way to let savings grow without unnecessary risk, and they play a key role in maintaining the real value of your money.

4. Pandemic-Era Spending Habits

The spending patterns developed during the pandemic haven’t faded for many. Back then, reduced expenses and stimulus checks created a cushion, leading to more luxury purchases and lifestyle upgrades.

Fast forward to 2025, and many people are still spending like they have that buffer, even though costs are up and extra funds have dried up. Maintaining those habits without adjusted income or savings goals quickly leads to debt and lost wealth-building opportunities.

5. The Rise of Sports Betting

Online sports betting has exploded in accessibility and popularity, with Americans spending roughly $72 billion in 2024 alone. While the convenience of placing a bet through a phone app may feel harmless, the truth is far less exciting.

The odds are rarely in favor of the bettor. The financial consequences add up fast, often quietly, and rarely deliver the reward people are hoping for. If left unchecked, it becomes a recurring expense that diminishes disposable income and derails financial goals.

6. Daily Convenience Spending

Freepik | Convenient online purchases often mask hidden fees, tips, and impulse buys that quickly add up.

Ordering food, shopping online, or booking services with a few taps is second nature now. But hidden behind those taps are service fees, delivery charges, tips, and impulse buying. These small, frequent purchases can quickly balloon into hundreds of dollars a month.

The ease of spending often blinds consumers to how much they’re giving away for convenience. Over time, that adds up to a significant cut into long-term wealth potential, especially when carried on credit and subject to interest.

7. Ignoring Personal Growth

One of the most overlooked ways to grow wealth is by investing in personal knowledge and skills. Many are quick to spend on the latest gadgets or a weekend trip, but hesitate to invest in a course or mentor that could multiply their earning potential.

Books, certifications, and coaching provide long-term value that outlasts any material purchase. While stocks and real estate are important, the foundation of financial success often starts with smarter personal decisions, and those come from better information and training.

Building real wealth in 2025 comes down to recognizing the quiet leaks in your finances. By adjusting daily habits, avoiding emotional decisions, and focusing on long-term value, it’s possible to stay ahead—even in a challenging economy. Small, intentional changes today can create lasting financial security tomorrow.

More in Business

-

`

US Opposes Hezbollah Ally’s Appointment to Lebanon’s Finance Ministry

The United States is actively pressuring Lebanese officials to block Hezbollah and its allies from selecting the country’s next finance minister....

February 12, 2025 -

`

Ed Sheeran Becomes the First International Artist to Perform in Bhutan

Ed Sheeran has achieved a groundbreaking milestone in his music career. The “Bad Habits” singer, 33, became the first international artist...

February 5, 2025 -

`

New Jersey Issues Warning to 11,000 Businesses for Selling Flavored Vapes

In New Jersey, flavored vape products are illegal, but thousands of businesses continue to violate the law. According to Attorney General...

January 29, 2025 -

`

Why Prince Harry and Meghan Markle Hide Their Children’s Faces Online

Prince Harry and Meghan Markle remain two of the most talked-about public figures, yet their approach to sharing details about their...

January 22, 2025 -

`

Why Are Innovation Hubs Crucial for Entrepreneurial Success?

Innovation hubs are transformative spaces that empower entrepreneurs by providing the resources, mentorship, and collaborative environments needed to turn their ideas...

January 14, 2025 -

`

How to Finance an ATM Business in 3 Easy-to-Follow Steps

Starting an ATM business can be a fantastic way to earn passive income, but the first hurdle is figuring out how...

December 19, 2024 -

`

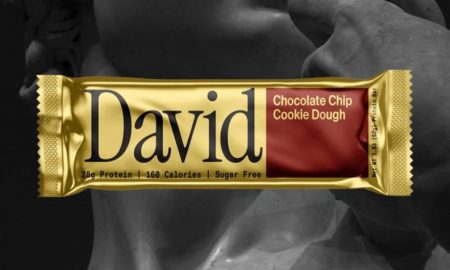

Former RXBar CEO Peter Rahal is Betting Everything on New Protein Bar Startup, David

Peter Rahal, the visionary entrepreneur behind RXBar, is back with a bold new venture. After selling RXBar to Kellogg’s for a...

December 15, 2024 -

`

Can investing in Nvidia Still Offer Value After Its Explosive Growth?

This year, Nvidia has been one of the stock market’s most impressive performers. Starting at $50 per share (split-adjusted) in January,...

December 6, 2024

You must be logged in to post a comment Login