Factors That Determine A Company’s Valuation

When companies start their valuations, they focus on improving price-earnings (PE) ratios by increasing revenue and margin-based sales. However, this approach handicaps the management teams as it largely affects a company’s ability to identify opportunities and defy threats. Threats arise when companies self-assess their value compared to the competitors in the industry and how they have changed their valuation with time.

Monstera/Pexels | A company must assess its value.

Lacking the ability to adapt to the new business model leaves the executives dependent on old thumb rules. The Board of directors may miss out on valuable signals of valuation changes, whether it’s driven by the company or market conditions.

Six Key Factors To Assess Valuations

Analysis of quarterly data from various companies has made it possible to drive six critical factors. These factors can be used to compare companies in the same industry or across industries. It can also help the companies understand how the market values affect their valuation over time.

Karolina/Pexels | Some companies use returns to shareholders to assess their company’s value.

The six factors are:

- Weighting forecasts of growth in the company’s revenue

- Trends in the cash returned to shareholders

- Weighing forecasted growth in company margin

- Improvement in a company’s debt-to-equity ratio

- The economic conditions prevailing in the company’s industry

- Market volatility in areas where the industry’s major companies operate.

Of the six factors mentioned earlier, the ones weighing the company’s margin and revenue are the factors that companies can control. The value of companies related to media and services is driven primarily by a margin. Hotel businesses and related service-providing companies rely primarily on cash and margin returned to shareholders. While revenue growth is essential even for the tech giants, the fact that most industries are growth driven is less known.

Usually, companies focus on short-term profits that harm the company’s valuation and ability to provide long-term returns. Different valuation methods are important for different companies. Margin and cash returns to shareholders play a vital role in the hotel industry, but they may not have the same importance for companies dealing with packaged meat.

Alexander/Pexels | Some companies weigh returns to calculate their value.

As a CEO, you should know the basis of complete research and what drives companies’ value. If you are a CEO new to the industry, then it’s best to let go of your pre-existing practices and devise new strategies.

More in Business

-

`

The Complete Relationship Timeline of Taylor Swift & Travis Kelce

When you think of unlikely couples, Taylor Swift and Travis Kelce might not be the first pair that comes to mind....

May 29, 2024 -

`

What is Business Administration and What Opportunities Does it Offer?

In today’s bustling world of commerce and industry, the term “business administration” often looms large, yet its true essence remains shrouded...

May 22, 2024 -

`

What is AI? Exploring the World of Artificial Intelligence

In today’s rapidly evolving technological landscape, the term “Artificial Intelligence” (AI) has become a buzzword that sparks curiosity, speculation, and even...

May 16, 2024 -

`

How Many Jobs Are Available in Real Estate Investment Trusts? Exploring Career Opportunities

Are you seeking a career path with a blend of financial savvy and a knack for the real estate market? Look...

May 9, 2024 -

`

The Staggering Net Worth of the Richest Podcaster Joe Rogan in 2024

Joe Rogan has become a household name, largely due to his immensely popular podcast, “The Joe Rogan Experience.” With a blend...

April 29, 2024 -

`

What Are Routing Numbers & Do Credit Cards Have One?

When managing your finances, understanding the various numbers and terms associated with your bank accounts and credit cards is crucial. A...

April 24, 2024 -

`

Tesla Stock: Let’s Address the Elephant in the Room

Why is Tesla stock dropping? This is the million-dollar question that has been on the minds of investors and enthusiasts alike...

April 16, 2024 -

`

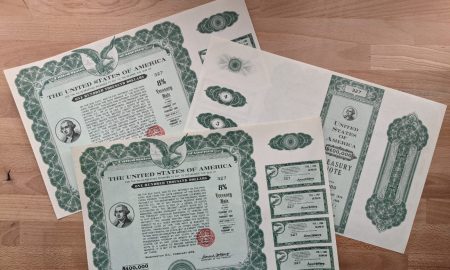

Bearer Bonds: Definition, How They Work & Are They Valuable?

Bearer bonds are unique securities that have a colorful history and a distinctive way of functioning that sets them apart from...

April 10, 2024 -

`

Is Gwen Stefani Pregnant? How True Are the Rumors?

The rumor mills are churning once again. But this time, the spotlight is on none other than Gwen Stefani. The buzz?...

April 2, 2024

You must be logged in to post a comment Login