Trump’s Tariff Targets Hollywood – The Entertainment Tax Explained

Tariffs on Hollywood films made headlines recently after a sudden announcement from the White House stirred major concern within the entertainment industry. The idea of taxing non-U.S. productions sparked confusion, and even though the White House later walked back the plan, the shockwaves hit fast.

As soon as the news was released, shares of Netflix and other media businesses fell. But the bigger question remains — what does an entertainment tax mean for the future of American film?

Hollywood Faces New Financial Pressures

The film industry has seen many changes, but tariffs present a unique challenge. Historically, President Trump has focused his tariff policy on physical goods like steel and automobiles. However, entertainment does not fit that mold.

Movies are a service, not a tangible product, and the United States actually exports more entertainment than it imports. The Motion Picture Association reports that American film exports are triple the volume of imports, and services in general give the U.S. a $300 billion trade surplus.

Instagram | @hollywoodsigntrust | Hollywood struggles as productions go abroad for lower costs and incentives.

Even with that advantage, the entertainment sector isn’t without issues. More productions are moving away from Los Angeles. Instead, filmmakers are choosing other states or countries where labor is cheaper and tax incentives are available. These shifts cost American jobs. Trump’s message was clear when he posted, “WE WANT MOVIES MADE IN AMERICA, AGAIN!”

Why a Tariff Isn’t a Simple Solution

Creating a tax on movies is not as straightforward as placing a tariff on manufactured goods. There are too many variables. Would the tax be applied to the production budget or the international box office? If a film like “James Bond” or “Harry Potter” shoots scenes in multiple countries, where does the tax apply? Does it matter where editing takes place? Even television shows would fall into this grey area.

Filmmakers argue that a 100 percent tariff could stop some productions entirely. Studios already manage tight budgets, and the added financial burden may push companies to cancel or move projects. Worse, foreign governments might respond with tariffs of their own, reducing the international profits that major studios rely on. Today, most of Hollywood’s revenue comes from overseas ticket sales.

Industry Leaders Prefer Incentives Over Penalties

Instead of tariffs, industry voices have proposed other ways to strengthen domestic filmmaking. A leading suggestion is to introduce or expand U.S. tax credits for films shot within the country. California Governor Gavin Newsom recently supported a $7.5 billion federal tax incentive to encourage local productions. His appeal to President Trump emphasized boosting American jobs without creating global trade conflicts.

That strategy would make filmmaking in the U.S. more competitive. Tax credits already draw productions to places like Georgia and Canada. Expanding them nationally could reverse the trend of overseas shoots.

However, implementing this plan comes with challenges. Funding such credits means Congress needs to allocate billions at a time when lawmakers are already looking for ways to offset recent tax cuts. Because of that, President Trump returned to his preferred approach — tariffs.

Why the Entertainment Tax Debate Affects Everyone

shutterstock | The entertainment tax discussion could increase costs for audiences and streamers.

This debate doesn’t just impact directors and producers. Consumers may eventually feel the effects, too. If productions become more expensive, ticket prices and streaming costs could rise. That would directly affect audiences and create more pressure on platforms like Netflix, Hulu, and Disney+.

Here’s how different groups could be affected:

1. Viewers – Higher movie prices or fewer content choices

2. Studios – Potential drops in global revenue

3. Filmmakers – Reduced creative freedom due to location and cost limits

4. Workers – Job losses if productions move overseas permanently

While the entertainment tax may sound like a behind-the-scenes policy, its ripple effect reaches across the industry and beyond. It’s a financial lever that, if misused, could limit content, change business models, and increase costs for audiences.

Looking Ahead

The conversation about entertainment tax policy is far from over. As the U.S. looks for ways to boost its domestic industries, the film sector remains a symbolic and financial powerhouse. Any new tax proposals must consider not just political messaging but also economic realities.

Leaders face a key decision: support the industry through investment or risk backlash through restrictive tariffs. The outcome will affect how movies are made, where they’re filmed, and how much they cost to enjoy.

More in Entertainment

-

`

US Opposes Hezbollah Ally’s Appointment to Lebanon’s Finance Ministry

The United States is actively pressuring Lebanese officials to block Hezbollah and its allies from selecting the country’s next finance minister....

February 12, 2025 -

`

Ed Sheeran Becomes the First International Artist to Perform in Bhutan

Ed Sheeran has achieved a groundbreaking milestone in his music career. The “Bad Habits” singer, 33, became the first international artist...

February 5, 2025 -

`

New Jersey Issues Warning to 11,000 Businesses for Selling Flavored Vapes

In New Jersey, flavored vape products are illegal, but thousands of businesses continue to violate the law. According to Attorney General...

January 29, 2025 -

`

Why Prince Harry and Meghan Markle Hide Their Children’s Faces Online

Prince Harry and Meghan Markle remain two of the most talked-about public figures, yet their approach to sharing details about their...

January 22, 2025 -

`

Why Are Innovation Hubs Crucial for Entrepreneurial Success?

Innovation hubs are transformative spaces that empower entrepreneurs by providing the resources, mentorship, and collaborative environments needed to turn their ideas...

January 14, 2025 -

`

How to Finance an ATM Business in 3 Easy-to-Follow Steps

Starting an ATM business can be a fantastic way to earn passive income, but the first hurdle is figuring out how...

December 19, 2024 -

`

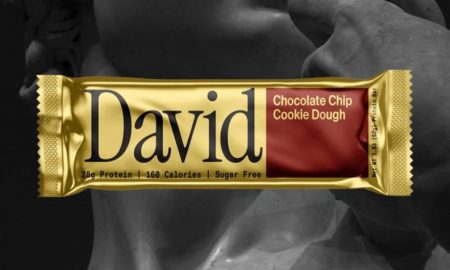

Former RXBar CEO Peter Rahal is Betting Everything on New Protein Bar Startup, David

Peter Rahal, the visionary entrepreneur behind RXBar, is back with a bold new venture. After selling RXBar to Kellogg’s for a...

December 15, 2024 -

`

Can investing in Nvidia Still Offer Value After Its Explosive Growth?

This year, Nvidia has been one of the stock market’s most impressive performers. Starting at $50 per share (split-adjusted) in January,...

December 6, 2024

You must be logged in to post a comment Login