Effective Tips for Managing Your Finances During Economic Uncertainty

In a time of growing financial instability, making smart money moves becomes more than just good advice—it becomes essential. From rising living costs to stock market swings, uncertainty has made many people rethink how they manage personal finances. With about half of Americans concerned about a potential recession, the need for strong financial planning has never been more urgent.

Experts say that while no one can predict the future, certain proactive steps can strengthen financial stability. And rather than reacting in fear, focusing on controllable habits builds resilience for whatever comes next.

Let’s explore the steps you can take to achieve financial stability, no matter what the economy throws your way.

1. Start With a Clear Picture of Your Finances

Before making changes, it’s important to know where things currently stand. Review recent expenses, categorize spending, and assess existing savings. This simple check-in offers a practical overview of what can be adjusted.

Freepik |syda_productions| Understand your current finances by reviewing expenses and savings before making changes.

Matt Watson, CEO of Origin, emphasizes that everyone—experts included—is navigating unknowns. “There’s no guaranteed way to forecast the future. What matters more is understanding your financial foundation,” he said.

A basic step, like reviewing debit card transactions or banking apps, can uncover patterns. These insights often reveal areas to tighten up spending with minimal discomfort.

2. Trim Non-Essentials Before They Trim You

Reducing expenses now can prevent tougher decisions later. Even small changes add up, especially when stretched across months.

Start by organizing spending into three groups:

1. Needs – essentials like rent, utilities, and groceries

2. Wants – things like dining out or subscriptions

3. Wishes – larger purchases like new gadgets or luxury travel

According to Jim Weil of Private Vista, scaling back “wishes” first is the most effective strategy. And although trimming “wants” can feel like a sacrifice, temporary shifts in lifestyle can free up funds that provide peace of mind down the road.

3. Build a Safety Net that Works for You

Economic downturns can disrupt even the best-laid plans. One strong defense is an emergency fund. Even modest contributions have an impact, even though it’s preferable to save three to six months’ worth of spending.

This fund offers a buffer for situations such as job loss, medical bills, or major repairs. Planning ahead, especially for upcoming events like moving or tuition, allows for a more robust emergency fund.

Consistency is key here. Set a monthly goal—even if it’s modest. Over time, the fund grows, and so does financial confidence.

4. Protect Mental Wellness Along the Way

Economic stress impacts more than just wallets—it affects mental health. Constant updates about job markets, interest rates, and inflation can raise anxiety levels. While staying informed helps with decision-making, constant exposure often leads to burnout.

Consumer advocate Courtney Alev advises balancing news intake: “Stay aware, but don’t let the headlines take over your peace of mind.” Managing mental health may mean stepping back from financial news or consulting a financial therapist if stress becomes overwhelming.

Affordable mental health resources are available through platforms like FindTreatment.gov, and many insurance plans offer coverage for therapy.

5. Keep Control Where It Counts

Rather than worrying about national policies or market fluctuations, it’s more effective to focus on daily money decisions. Budgeting, reducing spending, and making conscious financial choices offer far more influence over financial outcomes than trying to interpret economic forecasts.

Reevaluating monthly plans, even briefly, creates space to correct small oversights. If an old subscription is draining the account or grocery bills are higher than expected, adjusting in real time makes a meaningful impact.

6. Prioritize Which Debt to Pay First

Tackling debt in uncertain times requires a plan, not panic. Grouping debts into short-, medium-, and long-term categories helps sort priorities. High-interest debt—especially credit card balances—should come first.

Weil explains that paying more than the minimum on credit cards speeds up the payoff timeline and reduces long-term interest costs. In contrast, long-term debts like student loans or mortgages often have lower interest rates and can be managed more steadily.

For those overwhelmed by credit card balances, focusing on reducing credit usage while building an emergency fund is a wise next step.

7. Don’t Panic Over Market Changes

Freepik | creativaimages | Avoid emotional investment decisions during market volatility for better long-term returns.

With the stock market on a rollercoaster, the urge to pull investments can be strong. However, emotional reactions can result in greater losses. Staying stable typically pays off for long-term objectives like retirement.

“Try not to make emotional investment decisions,” says Alev. Sticking to the plan often results in a rebound over time, especially for retirement accounts like 401 (k) s. For those nearing retirement, shifting to conservative options can reduce risk without abandoning growth entirely.

8. Reinforce Financial Habits With Monthly Check-ins

One of the most effective habits during economic uncertainty is regularly reviewing the budget. These monthly financial check-ins keep goals realistic and highlight where course corrections are needed.

Alev puts it simply: “A budget is only helpful if it supports good decisions. Don’t hesitate to revise it when life changes.” Whether it’s a higher utility bill or unexpected medical expense, flexibility in budgeting keeps financial plans sustainable.

Strength in Routine Creates Security in Chaos

The road to financial stability isn’t about sudden transformations—it’s about steady, deliberate actions. Understanding where money goes, cutting back early, and creating even small savings cushions can provide major relief when challenges appear.

Stress around money may be common, but there are plenty of practical strategies that offer peace of mind. With consistency, mental clarity, and a few smart decisions, anyone can weather economic storms more confidently.

Best to stay calm, assess clearly, and act wisely—because preparation always beats panic.

More in Finance

-

`

US Opposes Hezbollah Ally’s Appointment to Lebanon’s Finance Ministry

The United States is actively pressuring Lebanese officials to block Hezbollah and its allies from selecting the country’s next finance minister....

February 12, 2025 -

`

Ed Sheeran Becomes the First International Artist to Perform in Bhutan

Ed Sheeran has achieved a groundbreaking milestone in his music career. The “Bad Habits” singer, 33, became the first international artist...

February 5, 2025 -

`

New Jersey Issues Warning to 11,000 Businesses for Selling Flavored Vapes

In New Jersey, flavored vape products are illegal, but thousands of businesses continue to violate the law. According to Attorney General...

January 29, 2025 -

`

Why Prince Harry and Meghan Markle Hide Their Children’s Faces Online

Prince Harry and Meghan Markle remain two of the most talked-about public figures, yet their approach to sharing details about their...

January 22, 2025 -

`

Why Are Innovation Hubs Crucial for Entrepreneurial Success?

Innovation hubs are transformative spaces that empower entrepreneurs by providing the resources, mentorship, and collaborative environments needed to turn their ideas...

January 14, 2025 -

`

How to Finance an ATM Business in 3 Easy-to-Follow Steps

Starting an ATM business can be a fantastic way to earn passive income, but the first hurdle is figuring out how...

December 19, 2024 -

`

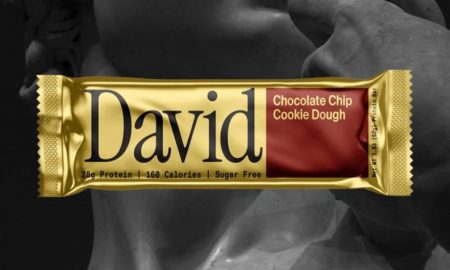

Former RXBar CEO Peter Rahal is Betting Everything on New Protein Bar Startup, David

Peter Rahal, the visionary entrepreneur behind RXBar, is back with a bold new venture. After selling RXBar to Kellogg’s for a...

December 15, 2024 -

`

Can investing in Nvidia Still Offer Value After Its Explosive Growth?

This year, Nvidia has been one of the stock market’s most impressive performers. Starting at $50 per share (split-adjusted) in January,...

December 6, 2024

You must be logged in to post a comment Login