Best Tech Stocks to Watch in May 2025 for High Growth

Markets are buzzing with optimism as investors respond to a blend of global trade relief and cooling inflation data. A temporary pause on U.S.-China tariffs has given major indices like the Nasdaq Composite and S&P 500 a strong push.

For investors keeping a close eye on high-growth sectors, tech stocks are once again commanding attention. These companies, many driven by strong R&D pipelines and innovation-heavy strategies, are showing impressive performance in both revenue and earnings metrics.

Here’s a closer look at some standout players making waves this month—and why they should be on any investor’s radar.

Cutia Therapeutics

Cutia Therapeutics, a company primarily focused on treating scalp and skin conditions in China and Hong Kong, has seen a remarkable growth phase. It reported a staggering jump in revenue—more than doubling from CNY 137.62 million to CNY 279.62 million. The leap, marked by a 103.2% annual increase, signals a serious shift in momentum.

Despite currently operating at a loss, Cutia’s deficit has narrowed dramatically. The company trimmed its net loss from CNY 1.96 billion to CNY 433.81 million, indicating that its strategy is taking shape. Projections show that the business is on track to become profitable within the next three years, with earnings forecasted to climb at a rate of 65% annually.

cutiatx.com | Cutia Therapeutics experienced a 103.2% jump in revenue to CNY 279.62 million.

This growth rate significantly outpaces market averages and shines a light on how effective the firm’s investment in research and development has been. It’s this focus on developing advanced skin care and scalp therapies that’s positioning Cutia as a contender in the competitive biotech space.

Xiamen Amoytop Biotech

Another name drawing investor attention is Xiamen Amoytop Biotech. Known for its work in recombinant protein drugs, the company has demonstrated steady, tangible progress. Over the last quarter, sales rose 23.5% to CNY 673.35 million. Even more notably, net income surged by 41.4%, hitting CNY 182.13 million.

This uptick can be tied back to the company’s commitment to expanding its biologics segment, which is now the main source of revenue at CNY 2.95 billion. And it’s not just about financial metrics—Amoytop’s recent dividend payout of CNY 0.62 per share also signals growing confidence in its operations.

Backed by consistent R&D expenditure, the company continues to push forward in drug innovation. This combination of operational discipline and forward-thinking product development makes it one of the more balanced tech stocks currently in play.

Unimicron Technology

Though Unimicron Technology has faced recent earnings pressure, its fundamentals still show resilience. The company, specializing in printed circuit boards and other electronic components, saw its net income decline from TWD 2,433.57 million to TWD 914.54 million year-over-year. But that’s only part of the story.

Revenue has continued to climb, increasing 12.4% year-over-year to TWD 30 billion. And despite the dip in earnings, future projections suggest a recovery is likely, with analysts expecting a 55% annual growth in earnings over the next three years.

One aspect that sets Unimicron apart is its continued engagement with global tech platforms and events. This indicates a strong push to maintain relevance in the international tech conversation—an important sign for investors looking for companies with staying power.

Who Else is Making Moves?

Freepik | Elicera Therapeutics with its 70%+ earnings growth, are rapidly expanding.

Outside of these three, a broader view reveals several other tech players seeing rapid expansion. Companies like Elicera Therapeutics and CD Projekt are logging earnings growth above 70%, while firms such as KebNi and Elliptic Laboratories are also attracting attention for their innovation-driven surges.

Here’s a sample of the top-performing global tech stocks based on revenue and earnings growth:

1. Elicera Therapeutics: 75.8% revenue growth, 107.14% earnings growth

2. JNTC: 34.26% revenue growth, 86% earnings growth

3. CD Projekt: 33.48% revenue growth, 37.39% earnings growth

Each of these companies brings a unique angle—whether it’s gaming, biotechnology, or hardware—and all are proving that adaptability and innovation can drive strong financial results.

Growth Signals That Shouldn’t Be Ignored

The current market climate offers a fertile ground for tech stocks that are aggressively scaling or making strategic shifts. Whether it’s through targeted R&D spending, regional expansion, or participation in key industry networks, companies like Cutia Therapeutics, Xiamen Amoytop Biotech, and Unimicron Technology are proving that momentum is achievable—even in uncertain times.

Their strategies are rooted in measurable progress, not buzzwords, and that’s what makes these names stand out. Investors tracking high-growth opportunities should keep an eye on how these players evolve through the rest of the year, as each of them demonstrates different—but equally compelling—paths to sustained profitability.

More in Tech

-

`

US Opposes Hezbollah Ally’s Appointment to Lebanon’s Finance Ministry

The United States is actively pressuring Lebanese officials to block Hezbollah and its allies from selecting the country’s next finance minister....

February 12, 2025 -

`

Ed Sheeran Becomes the First International Artist to Perform in Bhutan

Ed Sheeran has achieved a groundbreaking milestone in his music career. The “Bad Habits” singer, 33, became the first international artist...

February 5, 2025 -

`

New Jersey Issues Warning to 11,000 Businesses for Selling Flavored Vapes

In New Jersey, flavored vape products are illegal, but thousands of businesses continue to violate the law. According to Attorney General...

January 29, 2025 -

`

Why Prince Harry and Meghan Markle Hide Their Children’s Faces Online

Prince Harry and Meghan Markle remain two of the most talked-about public figures, yet their approach to sharing details about their...

January 22, 2025 -

`

Why Are Innovation Hubs Crucial for Entrepreneurial Success?

Innovation hubs are transformative spaces that empower entrepreneurs by providing the resources, mentorship, and collaborative environments needed to turn their ideas...

January 14, 2025 -

`

How to Finance an ATM Business in 3 Easy-to-Follow Steps

Starting an ATM business can be a fantastic way to earn passive income, but the first hurdle is figuring out how...

December 19, 2024 -

`

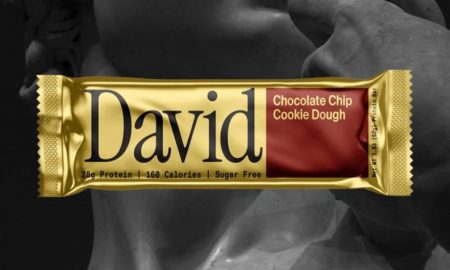

Former RXBar CEO Peter Rahal is Betting Everything on New Protein Bar Startup, David

Peter Rahal, the visionary entrepreneur behind RXBar, is back with a bold new venture. After selling RXBar to Kellogg’s for a...

December 15, 2024 -

`

Can investing in Nvidia Still Offer Value After Its Explosive Growth?

This year, Nvidia has been one of the stock market’s most impressive performers. Starting at $50 per share (split-adjusted) in January,...

December 6, 2024

You must be logged in to post a comment Login